Sopris Real Estate is an opportunistic real estate investment firm, backed by a single-family office, focused on co-GP investments and secondaries that range from $1 million to $15 million. Leveraging our ability to provide strategic liquidity to sponsors and LPs, we seek value in overlooked and undercapitalized segments of the market and opportunities that generate asymmetric risk-return. Sopris has a 20-year history of successful real estate investments across different asset types, strategies, deal structures, and geographies. Our team includes over 20 investment professionals across five different offices, including Charleston, Miami, Denver, Dallas and Aspen. Our real estate team is comprised of professionals with over 40 years of experience coming from institutions such as BlackRock, Citigroup, Wheelock Street Capital, Goldman Sachs, and SL Green.

Single source of capital enables us to maintain flexibility and move quickly.

Dynamic and Flexible Approach, with the ability to pursue differentiated, complex, and highly opportunistic strategies

Thoughtful Structuring, with maximum alignment between us and our partners

Value-add Partners, with a deep bench hailing from top real estate companies such as Goldman Sachs, BlackRock, Wheelock Street, and SL Green

Hotel redevelopment on North Berwick Golf Club.

Hotel redevelopment bordering Royal County Down Golf Club.

Hotel redevelopment on the 17th hole of the St. Andrews Golf Club.

Hotel redevelopment with unobstructed views of the 1st and 18th fairways of Royal Troon’s Old Course.

Affordable drive-to-leisure hospitality platform located near national parks catering to outdoor enthusiasts.

Opportunity zone adaptive reuse and mixed-use ground-up development project.

High quality multifamily development and redevelopment projects in Opportunity Zones.

Value-add multifamily properties within the U.S Southeast markets.

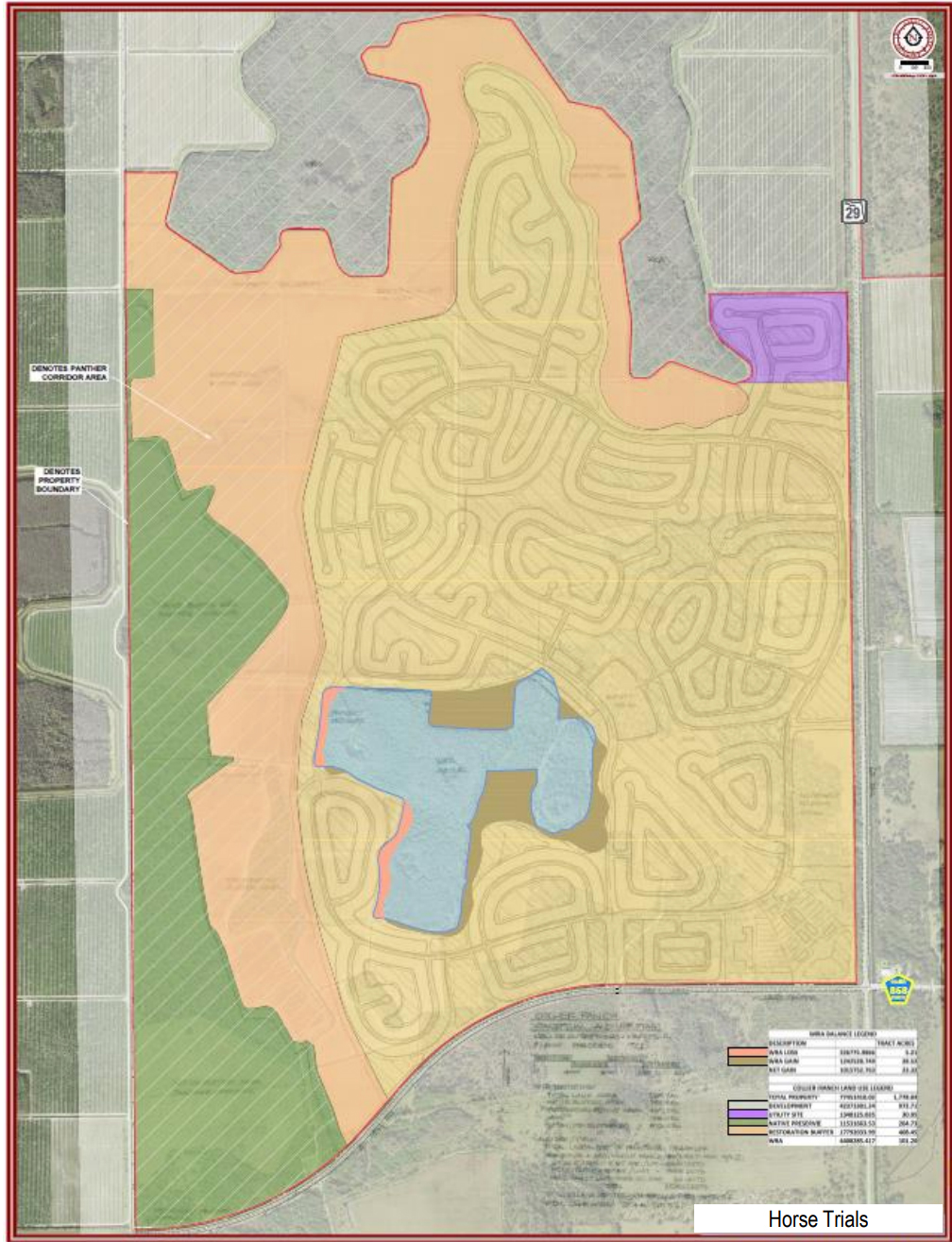

Land development strategy consisting of residential development, farm and ranch land, and citrus operations totaling 49,000 acres.

Hospitality and land development consisting of 500 residential lots, two golf courses, and six clubhouses.

Hospitality and land development strategy with a 200-key, 5 star Montage branded hotel.

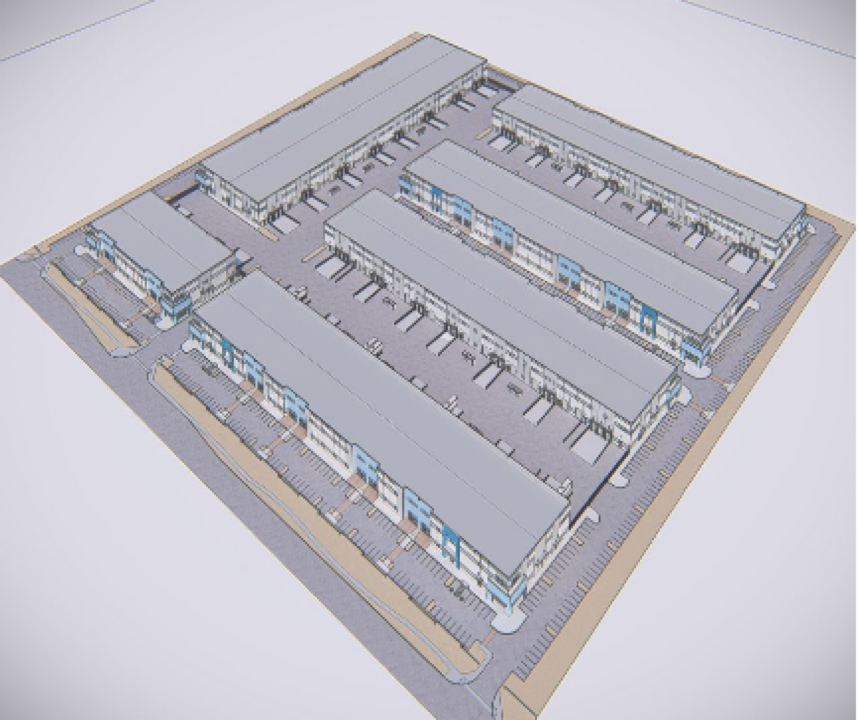

Industrial fund targeting the four largest non-coastal industrial hubs.

Value-Add multifamily.

Diversified fund investment focused on niche strategies including medical office, senior housing, and student housing.

Value-add diversified fund investment spread across 193 properties including medical office and senior housing.

Historic preservation redevelopment office to multi-family conversion project.

Office rehabilitation and film studio development project.

Value-add multifamily.

Horizontal land development project with the capacity to activate controlled assemblages sites into developments.

Extended stay hotel portfolio strategically located proximate to high growth suburban and metropolitan markets.

Light industrial opportunity zone development.

Credit strategy deployed for the development of luxury for-sale residential properties.

Preferred equity multifamily credit investments.